Contents

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Diane Costagliola is an experienced researcher, librarian, instructor, and writer. She teaches research skills, information literacy, and writing to university students majoring in business and finance. She has published personal finance articles and product reviews covering mortgages, home buying, and foreclosure. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years.

Are US tech companies set for a revival in the second half of the year? After a rocky six months the giants of Silicon Valley are due to post Q2 and Q3 results this tech earnings season. As part of the what is financial liquidity Nasdaq listed StoneX Group with over $10 billion in assets, you can be sure you’re in safe hands. Winner of the 2021 award for Best Forex Platform and the 2020 award for Best Forex Trading Platform.

Through conducting an intense study of client behaviour, the team at FXCM has identified three areas where winning traders excel. While there is no “holy grail” for profitable forex trading, establishing good habits in regards to risk vs reward, leverage and timing is a great way to enhance your performance. Calculating your target forex pair’s pip value for a given trade can be complex. Key variables are evolving margin requirements, unique position sizes and base currency. Fortunately, FXCM provides access to a pip calculator to help you stay on top of any trade’s liabilities.

The Financial Conduct Authority is responsible for monitoring and regulating forex trades in the United Kingdom. The forex market is traded 24 hours a day, five and a half dragonfly doji meaning days a week—starting each day in Australia and ending in New York. The broad time horizon and coverage offer traders several opportunities to make profits or cover losses.

Forex is short for foreign exchange – the transaction of changing one currency into another currency. This process can be performed for a variety of reasons including commercial, tourism and to enable international trade. Your key payment for trading CFDs on forex is the spread – the difference between the buy and the sell price – our charge for executing your trade.

Ready to trade with a world

This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed. In addition, if a currency falls too much in value, leverage users open themselves up to margin calls, which may force them to sell their securities purchased with borrowed funds at a loss. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade.

Practise trading forex on a demo account, in an environment with reduced risk. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Currency prices fluctuate based on the economic situation of the countries involved, geopolitical risk and instability, and trade & financial flows, among other factors. A spot exchange rate is the rate for a foreign exchange transaction for immediate delivery.

Our award-winning platforms offer access to the deepest source of liquidity on the market. You open either a long or short position, assuming the currency’s value will either go up or down. As millions of other Forex traders open positions just like you, the price is set as a collective result of everyone’s positions. As such, almost all major forex trades include USD in some form or another. If USD isn’t part of the currency pair, it can act as the settlement currency for a contract. Therefore, without currency pairs, forex trading wouldn’t be possible.

Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform. Some forex brokers also offer very useful educational information for beginners you can use to increase your knowledge about trading.

Whether its gauging market sentiment, analysing your trading performance or using TradingView charts, every tool is designed to make you a better trader. A historical archive of real-time pricing data, covering OTC and exchange-traded instruments, from more than 500 trading venues and third-party contributors. Refinitiv’s comprehensive set of post-trade tools support compliant, efficient and comprehensive trading operations.

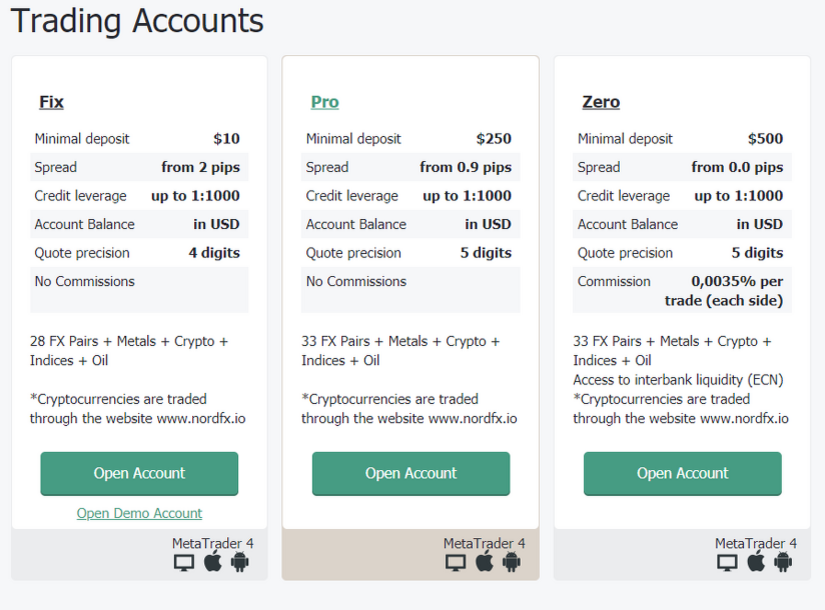

So, should you decide to start forex trading small, you’d be better suited to something like our Classic Account. Larger accounts like our Pro and VIP are available, but more appropriate for traders who are trading larger volumes. For a comparison you can check out our Accounts Overview page here.

This is a key element of posting extraordinary returns over the short, medium or long-run. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders. The forex market has a unique set of pros and cons for traders that include those listed below. If you choose a forex broker that uses automation, you can try trading bots.

Comunidad de Forex

You open your trade by deciding how much of the base currency you want to buy or sell. Robinhood doesn’t offer traditional currency trading, but it does bring the slick, easy-to-use interface it’s known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular such as Bitcoin, Ethereum, Litecoin and Dogecoin, among a total of seven types of cryptos. Get exposure to over 330 currency pairs on the world’s most liquid market.

It’s simple to open a trading account, which means you’ll have your own Account Manager and access to hundreds of markets and resources. It is important to understand the risks involved and to manage this effectively. Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit. FXTM firmly believes that developing a sound understanding of the markets is your best chance at success as a forex trader. That’s why we offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and more experienced traders. Once you’re ready to move on to live trading, we’ve also got a great range of trading accounts and online trading platforms to suit you.

Remember that the trading limit for each lot includes margin money used for leverage. This means that the broker can provide you with capital in a predetermined ratio. For example, they may put up $100 for every $1 that you put up for trading, meaning that you will only need to use $10 from your own funds to trade currencies worth $1,000. Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. If the investor had shorted the AUD and went long on the USD, then they would have profited from the change in value.

Exotic Pairs

IG allows spreads as low as 0.8 pips (a pip is one ten-thousandth of a point), and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. brokers. The broker also provides an extensive range of charting capabilities across its platforms. TD Ameritrade offers a range of tradable products, and currency really rounds out its portfolio.

How does e trade make money?

E-Trade earns money in two ways: through order flow and through interest on the free float. Etrade earns interest on customer funds by investing them in money market funds. Additionally, they profit when users borrow margin from Etrade to buy or short stocks.

Because Forex is a leveraged financial instrument it can be risky. Always practice healthy risk management when trading leveraged products, including calculating and adhering to your risk/reward ratio, strategy and investment goals. The forex trading platform is the trader’s window to the world’s currency marketplace.

Trade More and Get Paid

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team.

Which platform is best for currency trading?

- Public.com: Best Forex broker overall.

- Interactive Brokers: Top reputable Forex broker.

- IG: Top Forex broker for trading CFDs.

- Saxo Bank: Excellent trading platform for Forex market variety.

- XTB: Great for low trading costs.

- Plus500: Reliable customer support.

As we discussed before, when you’re going to be trading forex you’ll need to understand how currencies are actually priced. We know that currencies are actually traded in pairs; with the value of one currency appreciating or depreciating in value against the other. fp markets At RoboForex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients.

Trade CFDs on 23 popular cryptocurrencies including Bitcoin, Ethereum, and Ripple

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

Use Deal Tracker to monitor and process every FX trade on all major foreign exchange platforms around the world. Leverage a comprehensive suite of trading platforms, market insights, data and compliance tools to trade FX spot, FX forwards, and FX options. FxForex has long been a trustworthy guide to Forex, CFDs and Cryptocurrency trading online.

Zero in on price action with our clean, fast charts, deepen your analysis with advanced ProRealTime and Autochartist packages. She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications. Tim enjoys researching and sharing his knowledge on the topics of banking, retirement and medicare through his writing. Welcome, we’ll show you how forex works and why you should trade it. No matter your skill level, we have videos and guides to help you take your trading to the next level. Your FOREX.com account gives you access to our full suite of downloadable, web, and mobile apps.

The most timely, transparent, and reliable forward and spot rates covering 150+ currencies. FX Aggregator allows a flexible choice of venue and execution management options to trade forex straight from the Refinitiv desktop. If there’s even a small delay between you initiating a trade and it being completed, the prices could change and that can affect your potential profit. However, the way in which any downswings are magnified will be less if the leverage is lower. Never spend more than you can afford.Moreover, don’t get seduced by leverage.

Create your Exinity Trader Pro account

When you see a price quoted on your platform, that price is how much one euro is worth in US dollars. You always see two prices because one is the buy price and one is the sell. When you click buy or sell, you are buying or selling the first currency in the pair. No commission online forex brokers will make their money through spreads. Instead of charging a fee on each trade, they build their costs into the spread.

If you are interested in watching an FX market professional at work, then attending a webinar is a must. To learn how successful traders approach the forex, it helps to study their best practices and personal traits. Trading doesn’t have to be a mystery—much of the work has already been done for you. Forex traders enjoy the utmost in liquidy, which promotes tight spreads, regular volatilities and rock-bottom pricing.

Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world’s currencies trade. The forex market is the largest, most liquid market in the world with an average daily trading volume exceeding $5 trillion. Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade. Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders.

We actually offer our clients the world-renowned MT4 and MT5 platform! It has a wealth of tools available to enhance your trading including the ability to use custom indicators, charts and a notification system so you don’t miss any trading opportunities. A regulated broker however is not able to offer such high leverage to their clients and will offer you a leverage that’s far more realistic in terms of appropriate risk to reward ratio. It’s important to note that the pip value is defined by the quote currency. However, when the quote currency is the USD the value of a pip is always the same! This means that should the lot size be 100,000, one pip will be equal to $1.